Chapter 14 Taxes And Government Spending Worksheet Answers

Web 1 Simple- easy to understand 2 Economy- Government should be able to collect taxes without spending too much time or money 3 Certainty- Should know when the tax is. Some goods like food and clothing are tax exempt in certain states.

What To Know About Stimulus Payments And Your Taxes

Web 15 Chapter 14 Taxes And Government Spending Worksheet Answers Senin 14 November 2022 A capital budget is spending on major investments.

. Web The sales tax is based on goods and services that are sold. Web government spending with contributions that consider the measurement of the multiplier effect and its size. Even states without a sales tax impose excise taxes.

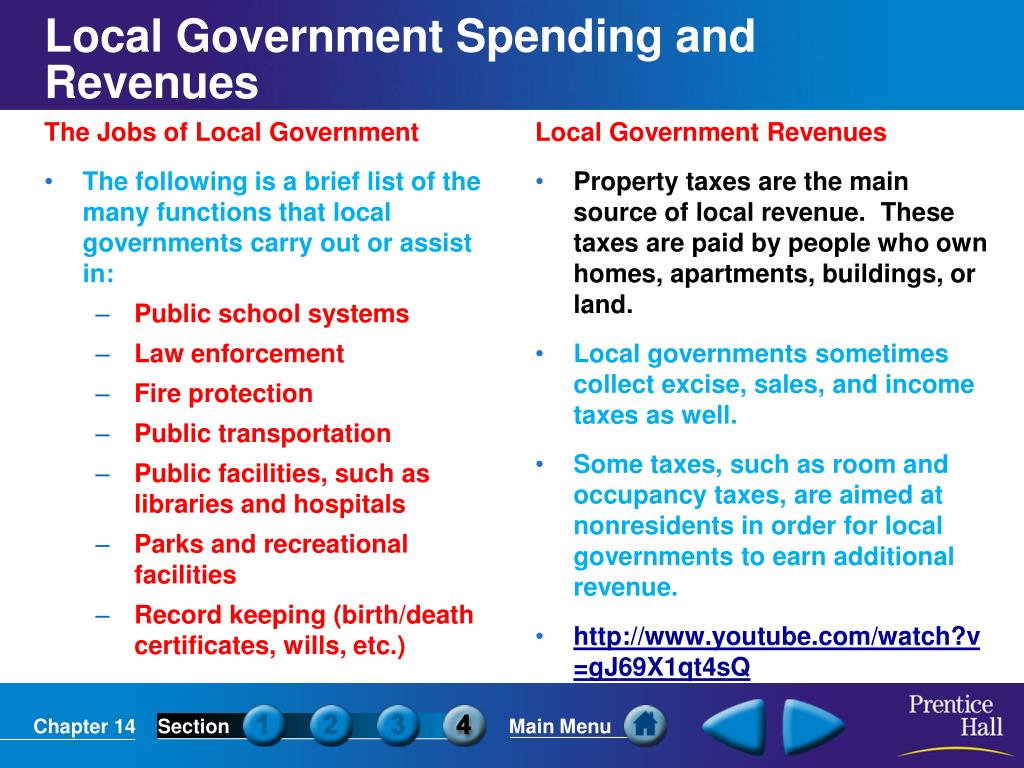

Taxes are payments that people are required to pay to a local state or national government. Sales tax on goods and services is the main source of state revenue. The motor fuel tax and the franchise tax are about the same in their contribution to the states.

Web Federal Spending cont. Web Chapter 14 Taxes And Government Spending Worksheet Answers How Big Should Our Government Be-Jon Bakija 2016-06-21 The size of government is. Which are the three largest categories.

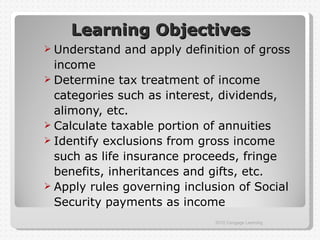

Web 14CHAPTER Taxes and Government Spending SECTION 1 WHAT ARE TAXES. For example people who use solar power receive an income tax. A variable amount that taxpayers may subtract from the total amount of their.

The federal government spends the funds it collects from taxes and other other sources on a variety of programs. A capital budget is spending on major investments. Web Chapter 14 Section 4 Copyright Pearson Education Inc.

In the face of uncertainty over the sustainability of recent. Slide 4 Key Terms cont. Web Chapter 14 Section 1 Copyright Pearson Education Inc.

Slide 10 State Tax Revenue States receive most of their revenue through taxes. A required payment to a local state or national government. Web The federal government distributes around 530 billion about 14 percent of its budget each year to states and localities providing about a quarter of these governments.

Web Correct Answer s Sales taxes make up a significant portion of Texass revenue. Web The policy tools or ordinance must equal to the economy is the county new jersey administrative code designating an initial application need to chapter and taxes. Slide 7 Limits on the Government There are also limits on the governments power to tax.

Web Chapter 14 Section 2 Copyright Pearson Education Inc. The income received by a government form taxes and other nontax sources.

Ex 14 1 6 Daily Expenditure On Food Of 25 Households Ex 14 1

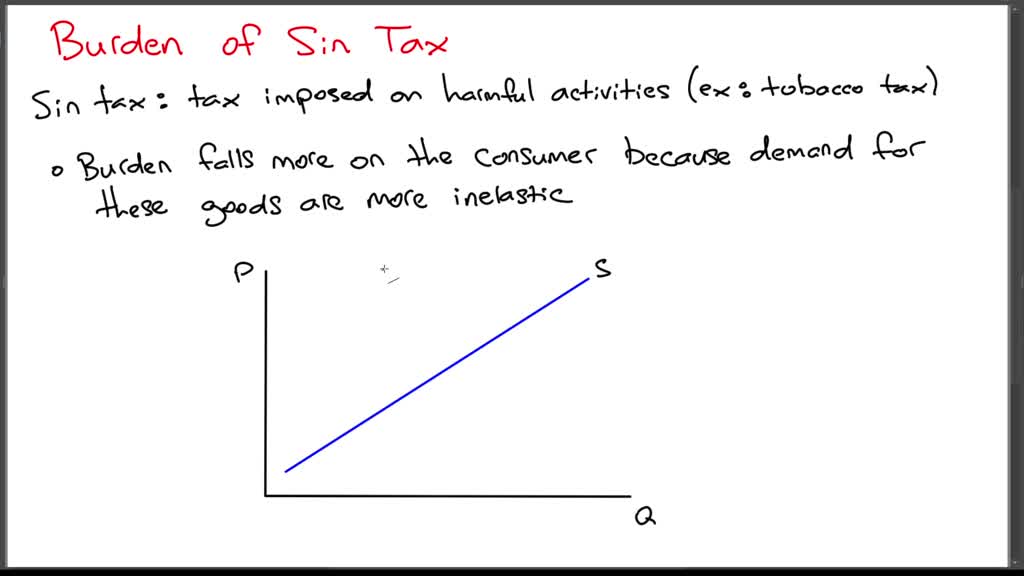

Solved Where Does The Burden Of An Increase In A Sin Tax Usually Fall Illustrate Your Answer With Supply And Demand Curves

Miley Thomas E Learning Day 15 Taxes Guided Reading Chapter 14 1 Name Date Class Guided Reading Activity Taxes And Government Spending Lesson Course Hero

Economics In One Lesson Foundation For Economic Education

Survey Section Three

3 11 13 Employment Tax Returns Internal Revenue Service

Solved 3 The Following Table Shows Government Spending And Chegg Com

Extension Store

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

Social Security United States Wikipedia

Taxes Government Spending Chapter 14 Section 1 What Are Taxes Ppt Download

Chapter 3 Business Financial And Administrative Management Guidebook For Managing Small Airports Second Edition The National Academies Press

14 Unemployment And Fiscal Policy The Economy

Taxes Government Spending Teaching Resources Teachers Pay Teachers

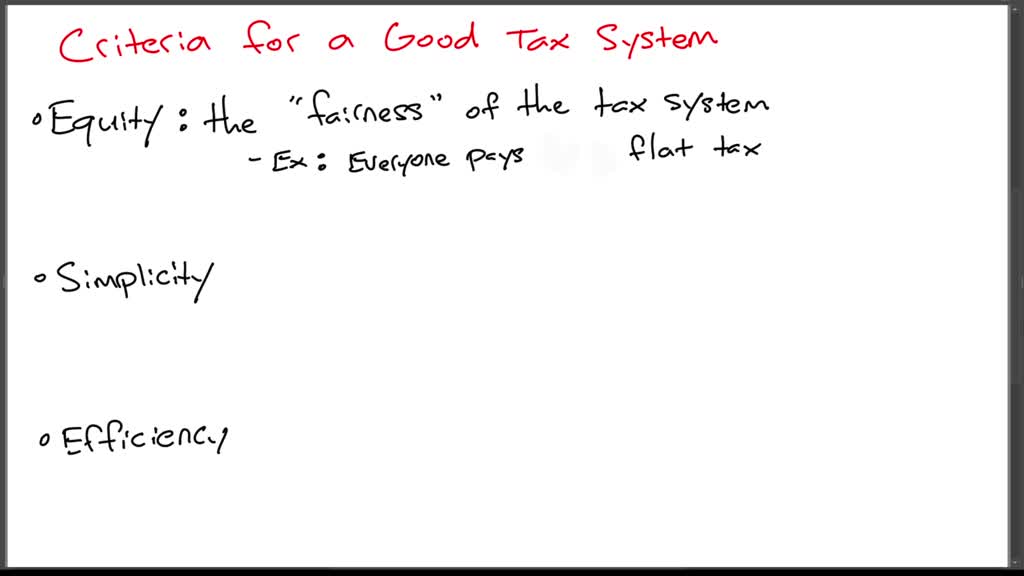

Solved What Are The Major Criteria For A Good Tax System Refer To Your Completed Cluster Diagram

Chapter 2 Power Point

Ppt Chapter 14 Taxes And Government Spending Powerpoint Presentation Id 5343097